Rewards Checking – Enjoy a checking account loaded with member perks – VantagePoints rewards1, nationwide ATM surcharge rebates, and easy-to-use mobile banking tools – all for $4 a month.

Key Features and Benefits

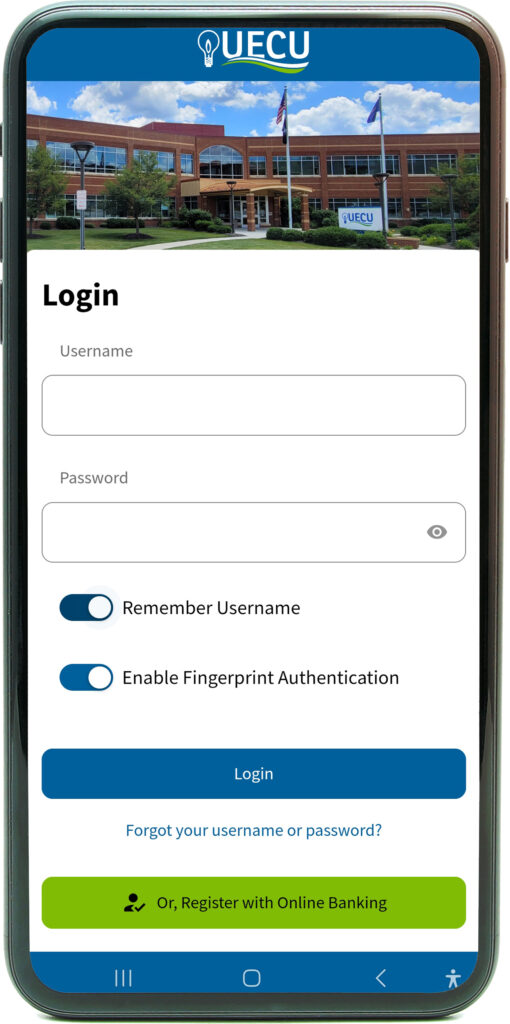

- Anywhere Banking Tools with Mobile and Online Banking

- Free SavvyMoney Credit Score & Report

- Earn VANTAGEPOINTS™ with Free Visa® Debit Card1

- Go Paperless & Earn Extra Rewards1

- Loan Discount2

Free Checks: First set is free.4

ATM Surcharge Rebates: Up to $8 per month

Fees: Maintain a $50 minimum daily balance to avoid the $4 monthly fee.

Account Details

- Advantages Visa® Debit Card™ perks:

- Nationwide ATM surcharge rebates – up to $8 per month

- VantagePoints™ Rewards1

- Mobile wallet capability with Apple Pay™, Google Pay, Garmin Pay™ and Samsung Pay

- Visa’s Personal Identity Theft Coverage3

- Additional debit card services: Card Controls, Visa Purchase Alerts, and Visa Click to Pay

- Digital banking services, including Mobile and Online Banking, Advantages Bill Pay™, and mobile check deposit

- Free checks – First set free

- .25% off new term loans2

- Direct deposit available

- Overdraft protection available

- $4 monthly service fee

Need Help? Want to convert your account to a Kasasa Checking Account?

Call 800.288.6423, or log into digital banking and send a secure message. Select the message option Convert My Account and let us know the account you prefer.

1 Advantages Visa® Debit Card™ holders earn 1 point for every $4 spent on Visa purchases – exclusions may apply. ATM cash transactions or cash advance transactions are not eligible to earn points. Advantages Visa® Debit Card™ holders, who go paperless and opt out of paper statements for their Member Statements, earn 1 point for every $2 spent on Visa purchases. You must be enrolled in Mobile or Online Banking to change your paperless settings and opt out of paper statements. For complete VantagePoints™ rules, visit uecu.org/rewards. 2 An active Rewards Checking or Rewards Checking PLUS account with at least one transaction per month may provide a rate reduction of .25% on select loan types. Exclusions apply, not all loan types are eligible for the .25% rate reduction, see credit union for details. 3 When you activate your Advantages Visa Debit Card™ you automatically receive Personal Identity Theft Coverage (at no cost to you), up to $2,500.00, to pay for expenses you may incur as a result of a Covered Stolen Identity Event. Identity Theft Coverage provided by Indemnity Insurance Co. of North America. Certain limits and restrictions apply. 4 First free set is limited to one style. Free set per calendar year is limited to a basic style in a choice of three colors.